Since the nation’s inception, we have had various and sundry policies to encourage the production of agricultural commodities to meet our food, feed, and fiber needs and, in time, fuel needs as well.

These policies have come in stages based on changing needs: Land distribution culminating in the Homestead Act to encourage farming and ranching. Education and research to augment productivity and quality of life on the farm. Improvements in information, marketing, and credit to help farm and ranch families weather the vagaries of Mother Nature and inherently volatile agricultural markets. And the farm safety net that has evolved over the years into a market-oriented set of policies that help producers survive in the face of the predatory trade practices used by foreign countries, including high subsidies, tariffs, and non-tariff trade barriers.

This safety net in the Farm Bill coupled with Federal Crop Insurance are the key ways that U.S. farm policy assists America’s farm and ranch families in mitigating the impacts of distorted markets due to predatory trade practices of foreign countries and natural disasters. This is made possible through a very small federal investment, with the entirety of the farm safety net constituting less than one-quarter of one percent of the total Federal budget.

President John F. Kennedy signs the Consolidated Farm and Rural Development Act of 1961 into law. The 35th President observed that the farmer is the only one “in our economy who must buy everything he buys at retail – sell everything he sells at wholesale – and pay the freight both ways.”

President George W. Bush at the signing of the Farm Security and Rural Investment Act of 2002. President Bush stated in his remarks, “American farm and ranch families embody some of the best values of our nation: hard work and risk-taking, love of the land and love of our country. Farming is the first industry of America — the industry that feeds us, the industry that clothes us, and the industry that increasingly provides more of our energy. The success of America’s farmers and ranchers is essential to the success of the American economy.”

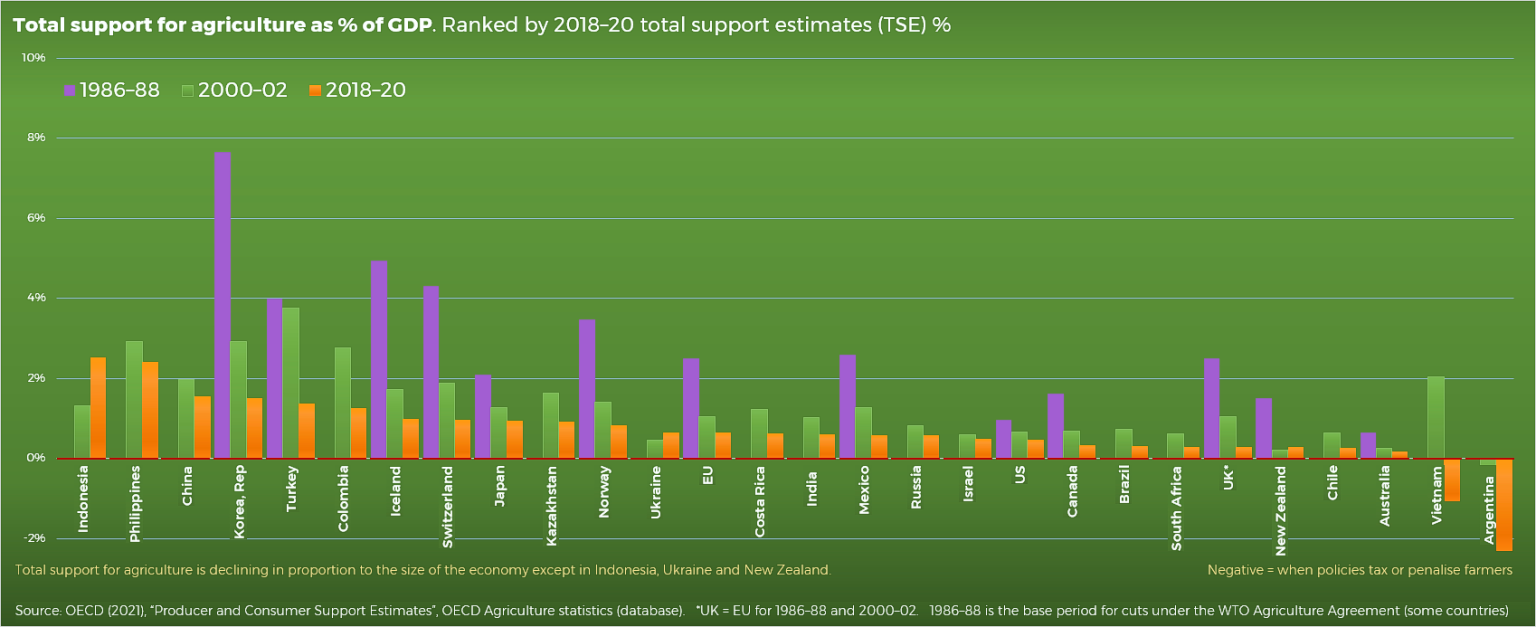

Since 2002, the Commodity Title has included a counter-cyclical feature to provide assistance to farmers when commodity prices or revenues fall below historic norms – today this takes place through Price Loss Coverage (PLC), and Agricultural Risk Coverage (ARC). The Title also contains market-clearing Marketing Assistance Loans (MALs) for farmers of a whole host of commodities produced across the country. Meanwhile, dairy margin coverage and sugar loans serve the nation’s dairy farmers and sugarbeet and sugarcane farmers. These policies are largely designed to help farm and ranch families mitigate risks beyond their control, including high and rising foreign agricultural subsidies, tariffs and non-tariff trade barriers, and other predatory trade practices. While these policies have proved crucial in the past, they have not kept up with costs of production and other market conditions and require updating to provide an effective safety net.

In a letter to the House and Senate Agriculture Committees in spring 2023, key agriculture groups laid out the case for strengthening the farm safety net.

“During the trade war with China that began in 2018, U.S. agriculture endured significant market impacts, which unfortunately revealed gaps in the farm safety net. If a trade war with our largest trading partner hardly triggered the farm safety net provided in the current farm bill – a Title I safety net that has been shrinking over the past 20 years – it is difficult to envision a scenario that would provide meaningful assistance without significant improvements. Continuing rising tensions with this important trading partner underscore the need in the next farmbill for a more meaningful, predictable farm safety net and the need to invest more into trade promotion programs to help diversify agricultural markets.”

Meanwhile, supplemental agricultural disaster assistance largely assists livestock producers and noninsured crop assistance provides help to producers of crops that are not insurable under Federal Crop Insurance.

Despite its vital importance, the Commodity Title makes up just 4.5 percent of the total Farm Bill budget and, together with Federal Crop Insurance, only 0.2 percent of the total Federal budget.

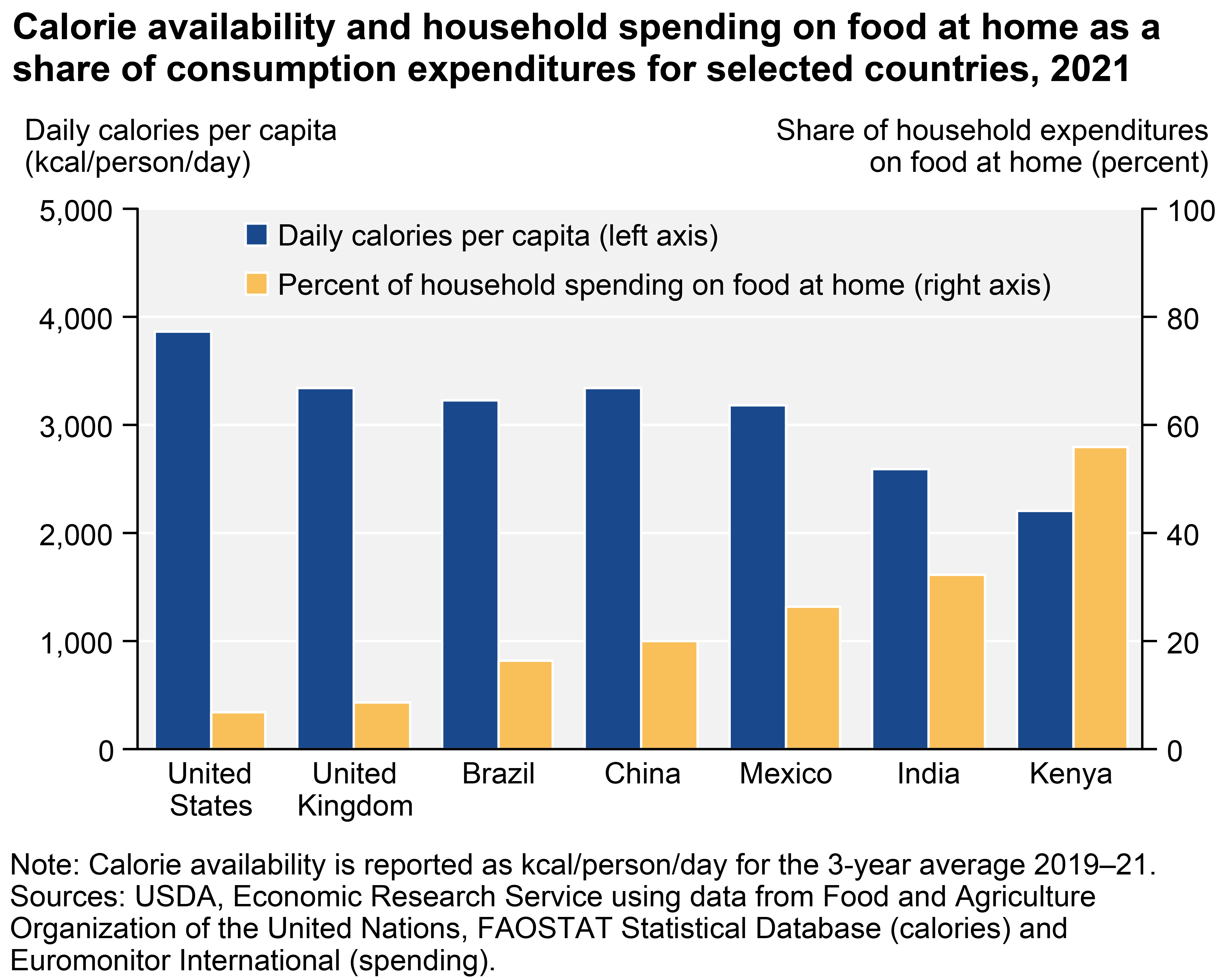

U.S. farm and ranch families, despite historic low levels of support and advancements in technology and innovation, face a slew of predatory trade practices when marketing products around the globe, from tariffs and non-tariff trade barriers, to stagnant and waning market access, and more.

“A similar story can be told concerning tariffs. Trade expert, John Gilliland, writes: According to the WTO, the simple average U.S. bound tariff rate on imported agriculture products is only 4.8%…By comparison, the averages in the largest U.S. trading partners are all higher: Canada has a simple average bound rate of 16.6%…Mexico has an average bound tariff rate of 45.0%…while the European Union’s [average is] 10.9% … Average tariff rates among developing countries are also generally much higher.” – Mr. Brandon Willis, Former USDA-RMA Administrator

Producer Support Estimates (PSEs) for agriculture: U.S. vs. China, 2007-2016.

Despite these headwinds, America’s farm and ranch families continually rise to the challenge of feeding, fueling, and clothing the world. A strong Commodity Title provides a crucial layer of the farm safety net as producers take on this momentous task year after year.