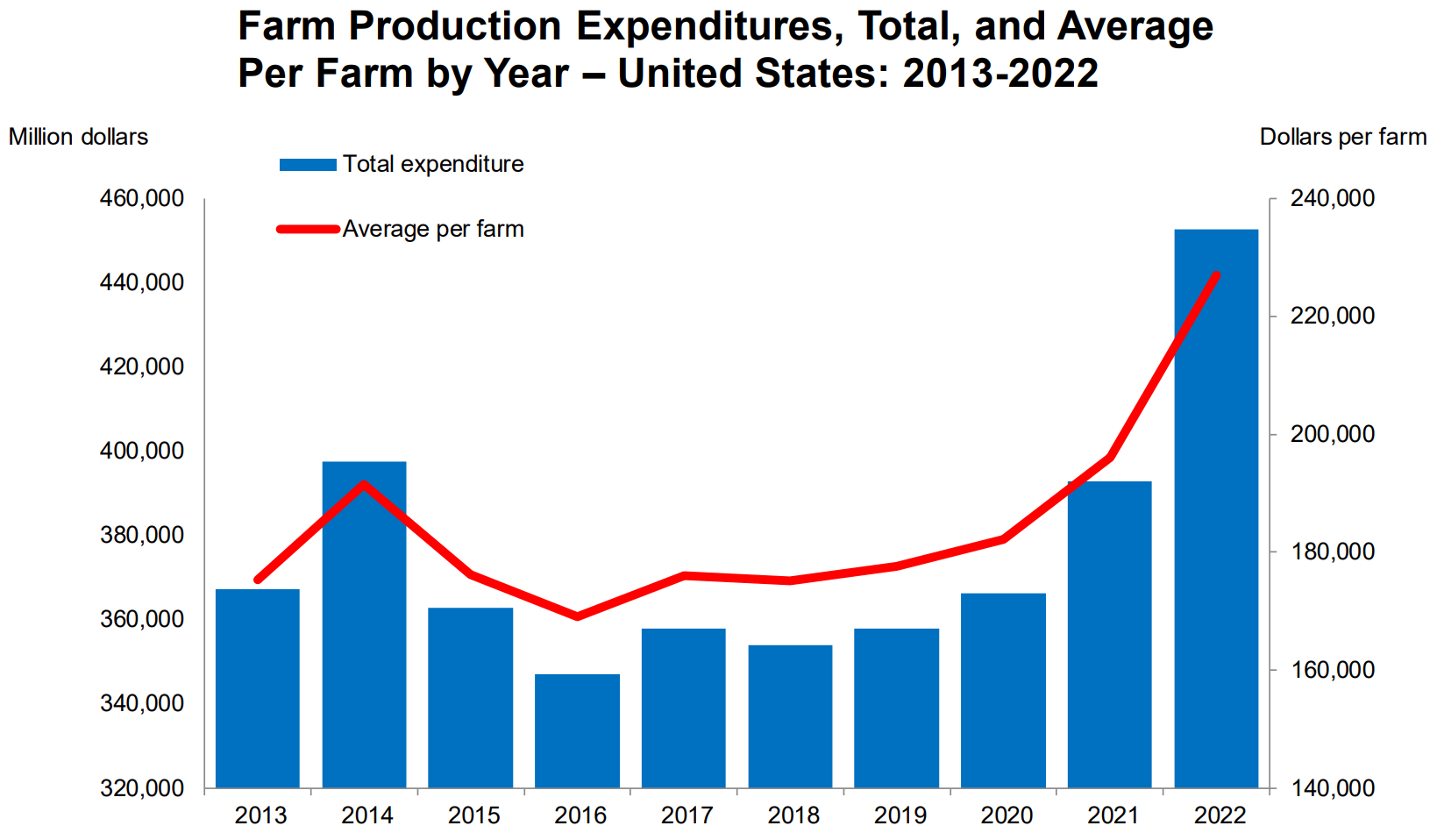

Farmers and ranchers routinely borrow more money in a year than most Americans will borrow in a lifetime in order to produce a crop.

Given the tremendous risks producers face, securing credit is not always easy.

The Credit Title is intended to ensure that farm and ranch families have the credit they need to produce the food, feed, fiber, and fuel we need.

Farm operating and ownership loans are generally available for this purpose. The loans are administered by the Farm Service Agency (FSA) which has offices in most counties throughout the nation, though for efficiency, FSA can utilize a more streamlined guarantee program with participating local banks. There are also special programs with more favorable terms for beginning and young producers, as well as socially disadvantaged producers. There are also emergency loans available.

The Farm Credit Administration and Farmer Mac are also authorized to help meet the credit needs of our nation’s farm and ranch families.

The 1980s farm financial crisis that shook the entire U.S. economy underscores the importance of ensuring ample credit in farm and ranch country. This period was marked by high inflation and concerted efforts to bring inflation under control through high interest rates. These conditions are, of course, very relevant today.