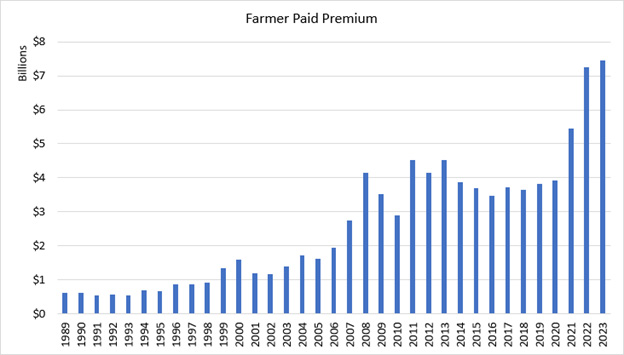

Although the Agricultural Adjustment Act of 1938 created Federal Crop Insurance, crop insurance barely hobbled along until 1980.

In 1980, Congress passed the 1980 reforms that turned the sales and servicing of Federal Crop Insurance over to private companies, agents, and loss adjustors. That year marked the beginning of Federal Crop Insurance’s meteoric rise to become what farm and ranch families say is the cornerstone of the farm safety net.

In 1994, another reform measure was approved by Congress in order to provide greater incentives for producers to buy coverage and at higher levels and to reduce the need for ad hoc spending. The impetus for the legislation was the 1988 drought and the 1993 flooding of the Mississippi River.

In 1996, Dr. Art Barnaby at Kansas State University sought approval of a revenue insurance policy for farm families. The Federal Crop Insurance Corporation Board of Directors ultimately approved the request.

By 1998, participation in crop insurance had increased to over 180 million acres covered.

In 2000, Congress again sought to incentivize greater participation in crop insurance at higher coverage levels through the Agriculture Risk Protection Act. The legislation aimed to address shortcomings in the system of actual production history (APH) that determines the production that producers may insure, and to expand availability and enhance effectiveness of crop insurance for all commodities, including specialty crops, livestock, and dairy. The law was an enormous success and helped Congress avoid large ad hoc programs over the next 16 years.

The 2018 Farm Bill further refined the APH system to ensure that producers do not face an effective double-deductible.

In 2017, Congress lifted the cap on crop insurance for dairy and livestock producers, paving the way for these policies to be the fastest growing under Federal Crop Insurance.

The results?

In 1989, roughly 50 commodities were covered under Federal Crop Insurance. Today, over 130 crops are eligible for coverage.

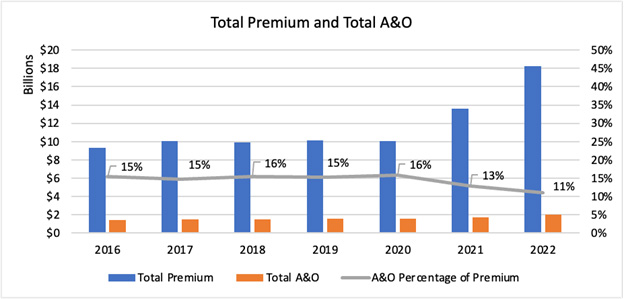

Federal Crop Insurance has grown from $2.5 billion in total premium paid covering 206 million acres and $34.4 billion in total liability to $18 billion in total premiums on 539 million acres with $180.8 billion in liability.