Last week was busy for the anti-farm crowd in their quest to leave farmers with fewer tools to deal with depressed crop prices and weather disasters.

First up was a new proposal by Senators Jeanne Shaheen (D-NH) and Pat Toomey (R-PA) to essentially write America’s sugar farmers out of the next Farm Bill.

The “Sugar Policy Modernization Act” would prohibit sugar growers from receiving nonrecourse loans available to other crops – loans that are repaid with interest and are the main component of U.S. sugar policy. The bill would also mandate that the USDA keep America’s sugar market flooded with imports to artificially depress prices for multinational food companies.

“A better name would be the ‘Sugar Farmer Bankruptcy Bill’ because that’s exactly what it’s designed to do,” explained Galen Lee, a sugarbeet farmer from Idaho.

It’s a devastating bill for rural communities from coast to coast all by itself, but Shaheen wasn’t finished.

A day later, she teamed with Senator Jeff Flake (R-AZ) to introduce legislation designed to deny farmers access to insurance policies that provide some revenue stability amid price declines and low yields.

These policies are vital to farmers who forward contract crops and to farmers forced to purchase feed for livestock following the loss of their own crops. And they are extremely popular, covering more than 9 out of 10 acres of U.S. corn and soybean in the crop insurance system. Revenue coverage is also used on 87% of wheat policies and 81% of cotton.

In other words, if you farm, chances are good the lawmakers took a swipe at your livelihood last week. And their rationale for doing so was to save taxpayers money, which is nonsense.

First, sugar policy has operated without taxpayer cost for the entire 2014 Farm Bill – well below Congressional Budget Office (CBO) estimates. Simply put, it has a $0 price tag and has cost taxpayers less than expected.

Meanwhile, farmers help fund crop insurance with money from their own pockets – and they have to pay a lot more for revenue coverage. Under this cost-share structure, crop insurance’s 10-year cost projection by CBO is down nearly $10 billion since 2013.

No, these bills are not about taxpayers. The proposals are anti-farmer, plain and simple, and they embody the harmful rhetoric used by long-time agriculture critics like Heritage.

So, we thought it only fitting to use a Heritage-produced prop in this column.

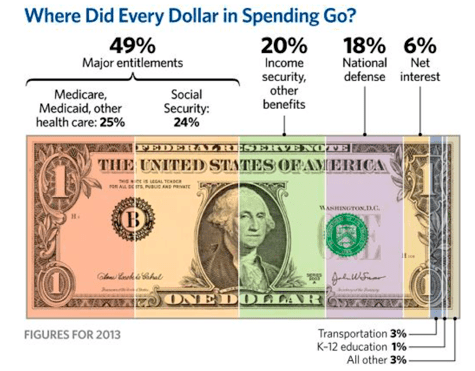

If saving taxpayer money is the goal, this Heritage graphic shows exactly where all those federal dollars go.

And if you’re having trouble finding agriculture listed, that’s because it is not. Farm policy is a small fraction of the “All other 3%” category, with crop insurance accounting for about 0.3% of federal expenditures. Put another way, America protects the food and fiber supply on which every citizen depends for far less than a penny per tax dollar.

In a recent speech, Dr. Joe Outlaw, of Texas A&M University, referenced this very chart.

“My question for Heritage is why aren’t they looking at these other areas of the budget,” he asked, questioning why so much time and energy is being spent on a small line item like agriculture.

It’s also a good question for all the Senators behind this week’s blindside against rural America.